A New Year and New Considerations

As we launch into a new year of residential sales across B.C.s Lower Mainland, there are developing issues that prospective home buyers and sellers will want to track, such as how increased mortgage rates and how new government regulations on qualifying for a mortgage may affect the market. I want to help my readers keep abreast of these developments and to make sense of the real estate market dynamics, so I invite you to check this newsletter each month for the latest updates.

In this my first newsletter of 2018, I will start with an overview of the how the residential market place looks compared with last year. This will give you a baseline for watching trends over the coming year, and hopefully will help your plans for either a selling or buying transaction, or simply being an interested observer of one of Canada’s most active real estate market places. I will start first with Metro Vancouver, with the most recent figures from the Real Estate Board of Greater Vancouver

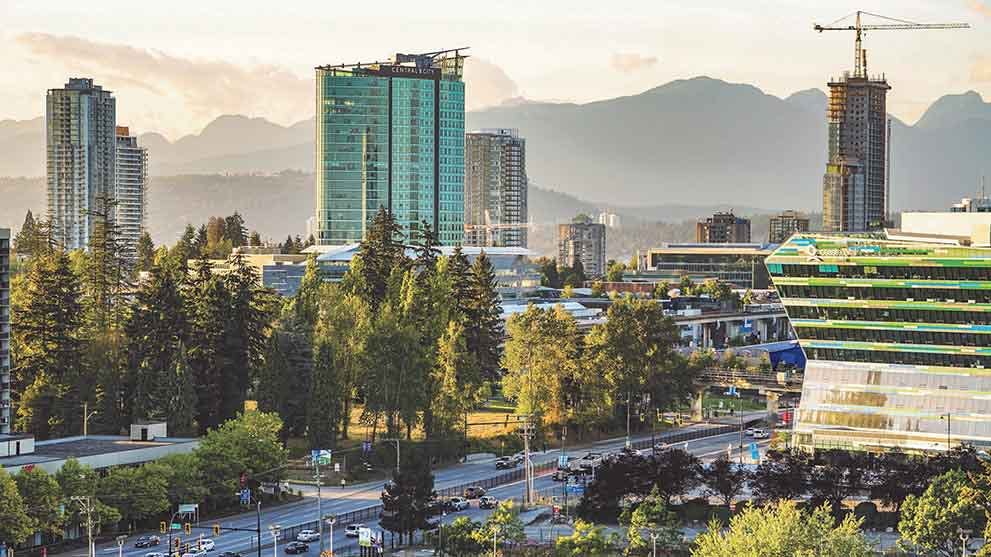

METRO VANCOUVER

Overall, residential prices in the Greater Vancouver area (Metro Vancouver) rose substantially during 2017. The composite Benchmark price for all residential properties in Metro Vancouver at the end of last year was $1,050.300. That was almost 16 per cent higher than one year earlier. Breaking down the year-over-year increase to different property types, detached properties rose 7.9 per cent; townhouses rose 18.5 per cent; and condominiums rose 25.9 per cent. The higher relative price increases reflect greater sales activity in the latter two categories.

Detached properties

As was the case for much of last year, detached properties did not show large month-to-month price increases. In that category it still appears to be waiting game. Owners of detached homes are not rushing to list their properties at a Benchmark price of $1,605,800. If it is price that determines when to list a property for sale (remember the maxim: ‘everything has its price’), this suggests owners see more residual value in their detached properties than the current price level would fetch. There was actually a decrease of 54 per cent in detached listings from November to December 2017. So, if you want to consider the purchase of a detached home at this time, I believe it would be an excellent investment even at Benchmark price over $1.5-million. You should also keep in mind that new government regulations on mortgage qualifications (see my blog post for December 2017, Your December Real Estate Recap), as well as the prospect of higher interest rates coming later this year, will likely shrink the number of buyers for higher priced properties in the detached property category. For home seekers with a lower price in mind, I would recommend looking in townhouse or condominium market where there are some very good opportunities with Benchmark prices for properties in Metro Vancouver still under $1-million.

Townhouses and Condominiums

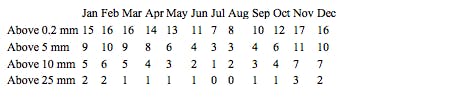

The Benchmark price for townhouses in Metro Vancouver at the beginning of 2018 was $803,700 and for condominiums $655,400. For townhouses, this was a slight decrease of 0.2 per cent from the previous month, while for condos it was an increase of 1.1 per cent. In last month’s newsletter I said I would watch a possible widening in the difference between townhouse and condo prices based on monthly increases and decreases. The current differential is a total of a 1.3 per cent compared to last month’s 0.7 per cent, so it is continuing to look as if a widening gap is beginning. It is too early to be certain at this time, but I’ll continue to track this metric so you can check next month to see how it is developing. Below is a breakdown of my suggested areas to look for these two property types based on Benchmark prices at the end of December 2017. This month I have selected three areas with the greatest month-over-month increase and three with the biggest declines, but each with prices still under $1-million.

For townhouses, the greatest increases in Benchmark prices were in East Vancouver at $879,200, a 2.0 per cent increase over one month; Ladner at $776,900, a 2.7 per cent increase over one month; and North Burnaby at $728,200, a 2.3 per cent increase over one month. The biggest decreases from the preceding month (excluding the outlying areas of Whistler and Squamish) were in North Vancouver at $982,800, a decrease of 0.1 per cent over one month; Port Coquitlam at $632,700, a decrease of 0.5 per cent over one month; and Maple Ridge at $527,500, a decrease of 1.0 per cent over one month.

For condominiums, the greatest increase in Benchmark prices were in Richmond at $637,200 an increase over one month of 4.0 per cent; Pitt Meadows at $422,800, an increase over month of 2.1 per cent; and Burnaby East at $681,400, an increase over one month of 1.9 per cent. Two others also had month-over-month increases of 1.9 per cent: New Westminster at $503,300 and Coquitlam at $502,900. Three areas had one month decreases: North Vancouver at $560,600, down 1.0 per cent; Tsawassen at $462,400, down 1.1 per cent; and Vancouver West at $807,100, down 0.5 per cent.

FRASER VALLEY

The Benchmark price for a detached property in the Fraser Valley at the end of last year was $976,400, a slight increase from the preceding month but still under the $1-million bracket in Metro Vancouver. However, as was the case throughout the year, townhouse and condominium sales dominated residential sales in the Valley at the end of 2017. These two property types made up more than half of all Valley sales 2017, with 5,198 townhouses and 6,183 condominiums.

The Fraser Valley continues to be the area of choice for many first-time home buyers in 2018, both for young families and individuals starting out in their careers. It offers very attractive properties in comfortable and enjoyable neighborhoods with excellent lifestyle options for both families and singles. Public transportation planning across the region makes any of the municipalities an excellent investment option for the long term. And with prices still significantly below those in Metro Vancouver, the Fraser Valley continues as one of the hottest residential markets. In the month December 2017, there were a total of 1,344 sales, the second highest December volume ever. Nonetheless, there were 1,277 new listings during the month, and the inventory for December 2017 ended with 3,818 active listings, so I encourage anyone looking for Valley home to shop seriously at this time. Below I make my monthly recommendations for the areas to search for excellent value. For each property type this first month of January, 2018, I have chosen to compare the year-over-year increase along with the last month increase or decrease. In some municipalities the Benchmark price has crept above the $1-million mark for the first time. Many clients in this market segment want to consider their investment compared to Metro Vancouver, so I have therefore selected four municipalities where the detached Benchmark price is over $1-million. For townhouses and condos, I have selected areas with the biggest increase from one year earlier.

Detached Homes

At the end of 2017, the December Benchmark price in Surrey/White Rock was $1,472,300, an increase of 4.8 per cent from one year earlier, and an increase of 0.2 per cent from the preceding month. The Benchmark price for a detached property in Surrey Central was $1,014,900, an increase of 17.1 per cent from one year earlier, and an increase from one month earlier was 0.2 per cent. In Cloverdale, the December Benchmark price was $1,004,900, an increase of 17.2 per cent from one year earlier, and an increase of 0.7 per cent from the preceding month. In Langley the December Benchmark price was $1,002,200, an increase of 15.8 per cent from one year earlier, and a decrease of 0.5 per cent from the preceding month.

Townhouses

The biggest year-over-year increase in townhouse Benchmark prices at the end of December 2017 was in North Surrey with a Benchmark price of $414,200, an increase of 28.8 per cent from the end of 2016, and a 1.8 per cent increase over the preceding month. The Benchmark price in Surrey Central was $549,700, an increase of 27.2 per cent from the end of 2016, and an increase of 1.6 per cent from the preceding month. In Cloverdale, the Benchmark price was $572,600, an increase of 26.9 per cent and a 0.9 per cent increase from the preceding month.

Condominiums

North Delta saw the biggest year-over-year increase in the Benchmark price for condominiums. There the Benchmark price at the end of 2017 was $361,800, an increase of 44.1 per cent since the end of 2016, and a 3.9 per cent increase over the preceding month. The Benchmark price in Langley was $396,900, and increase of 40.3 per cent over one year, and an increase of 2.0 per cent from the preceding month. In Abbotsford, the Benchmark price was $286,600, an increase of 33.6 per cent over one year, and a increase of 2.5 per cent from the preceding month.

I hope you fill find these suggestions helpful, and I wish you great success in your home search or sale as we begin this new year. I am always eager to help my clients in any way I can. Remember, I keep a close watch on market changes, so please feel free to call me any time you have a question.

Thanks for reading!

Sibo Zhang, REALTOR®